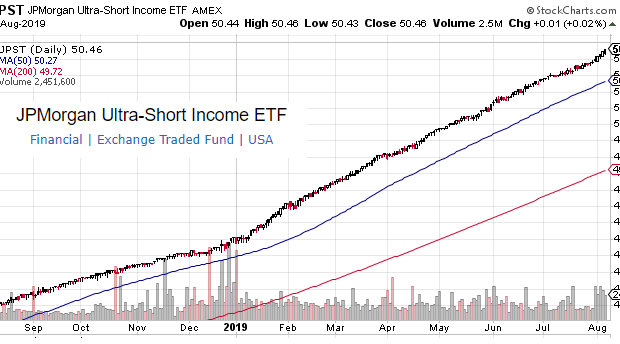

Managing funds is one of the most difficult tasks in the market. We are going to study about jpst in this section. The cash alternative everybody needs. The ideas listed below are discussed with the members of the private investing community, cef/etf income laboratory. Some of the highlighted funds are mint, jpst, near. The jpst stock at https://www.webull.com/quote/bats-jpst is a medium that helps manage the fund and tries to maximize income and preserving your capital utilizing usd in a specific duration of one year.

Performance and perspective

The steadiness of funds was preserved for years until there was a massive drop. When we talk about this massive drop we try to look from the perspective of performance. From a point of view of the cash alternative of an investor, this can be more destructive than any imagination. However, in contrast i would still prefer that these positions can be utilized for a safe place. These shallow declines are provided but we can also pick funds with steep discount rates in cef space.

The massive drop

The need of raising cash explains the reasons behind the massive drop in these funds. Due to the collapse of investors in the market there’s a need for raise in cash. Joining the fact with this is that everyone wants to liquidate the position of themselves.

Ytd returns

Ytd is what we need to consider while looking for a cash alternative. The only risk involved in these are its prices for security investment can change anytime. Cash is cash even if it is invested in a short period. In opposition, these funds are not a terrible place to invest your money into better opportunities when they are presented. The dividend yields of all these 3 funds show that fed cut their target rates from the range of 0 to 0.25%. This indicates the yields of these funds trend downwards from here. On collapsing the slight spike in yields is seen.

In a shorter duration, jpst is one of those attractive places where we can put our funds securely. Not certainly being risk-free but these funds react at the time of crisis. The drop is compounded by the fact that the discounts are open up on the etfs. These investments are not for longer duration but as opportunities, as we saw in march, the cash alternative type position is reduced. The value of some cef’s is too attractive during this time. For more stock information like plm stock, you can check at https://www.webull.com/quote/amex-plm .